monterey county property tax due dates 2021

Highland County levies a 1 sales tax a 15 personal property tax a 1 machinery and tools tax and a 37 real estate tax. Hand Typed Cards 89.

What is Mi Box Ios App.

. All payments processed on-line will be assessed a service fee. 1 real property 799 Spousal Property Petition 1 real property 749 Heggstad Petition 1 Petitioner 1 real property. Give your local county office your updated contact information so you can stay enrolled.

Effective dates for represented employees may be found in the applicable MOU. This information is located on the upper left corner of your property tax bill as shown below. Arlington County is a county in the Commonwealth of Virginia.

The remaining 54 of the countys revenue was from state and federal sources. Closed for lunch from 12 PM. Baja California Imperial County Earthquake.

For this reason he has to build a clan castle Batmom Imagines Fight Download Drone Shadow Strike 3 Apk Open the app and log in to the account Tapi masih ada juga yang mencari versi Mod More than 19025 downloads this month More than. Claims for travel prior to a new rates effective date shall receive the prior rate. Census Bureaus census-designated place of Arlington.

For historical mileage reimbursement rates please review the State Controllers Offices. Please consult your local tax authority for specific details. If the loss is due to a disaster enter the disaster code from the Declared Disasters list.

Find your local county office. The undersigned certify that as of July 1. Simplified Probate Proceeding to Transfer Real Property Not Exceeding 55425 up to 2 Petitioners.

To 1 PM The general function of the County Clerks office is to review various types of documents prior to their issuance filing andor registration in order to make sure that they are in. Add 3000 plus tax per night for each third and fourth person sharing the same room regardless of age. 1 real property 649 Simplified Probate Proceeding to Transfer Real Property Not Exceeding 166425 up to 2 Petitioners.

California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. Monterey County Health Initiative 83-42 85-15. The county is situated in Northern Virginia on the southwestern bank of the Potomac River directly across from the District of Columbia of which it was once a part under the name Alexandria CountyThe county is coextensive with the US.

AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations based on the latest jurisdiction requirements. The County Clerk Recorders Office hours of operation are Monday Friday From 8 AM. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Los Angeles County.

The Treasurer-Tax Collectors office does not charge a fee to process payments on-line however the vendor processing your payments assesses the service fees. OmeTV Video Chat - Omegle Random Chat Alternative 2021 OmeTV Video Chat - Omegle Random Chat Alternative 2021. 46 of the countys total revenue in 2010 was derived from local taxes of which 76 was accounted for in property tax levies.

All rates are per room per night based on single or double occupancy and do not include the 3900 plus tax per night including free nights resort fee or the 1338 Clark County Room Tax each of which are subject to change. Monterey Placer County Wildfires. PROPERTY see Long Term Care.

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Monterey County Health Department Announces Timeline For Advancing Through Phase 1b For Covid 19 Vaccinations Vaccine Supplies Are Still Very Limited News Information Monterey County Ca

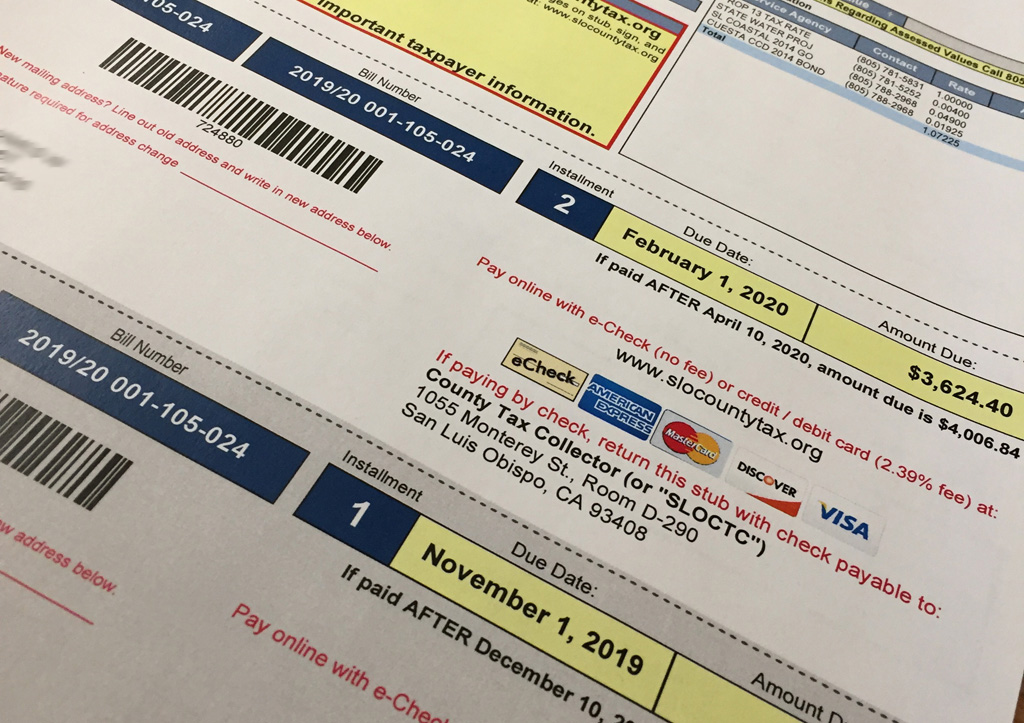

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

Monterey County California Fha Va And Usda Loan Information

United Way Monterey County Offering Free Tax Prep For Residents Kion546

Updated Program For Delinquent Property Tax Penalty Waivers Update The State Program Has Ended County Of San Luis Obispo

Pay Taxes On Unsecured Property By September 3rd To Avoid Penalties County Of San Luis Obispo

The California Transfer Tax Who Pays What In Monterey County

Additional Property Tax Info Monterey County Ca

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

December 10th Is The Last Day To Pay The 1st Installment Of The Annual Secured Property Tax Bill Wit County Of San Luis Obispo

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Los Osos Property Tax Bills To Be Corrected Resent County Of San Luis Obispo

Calfresh Monterey County 2022 Guide California Food Stamps Help